But Will He Be Happy With a ’69 Beetle for Graduation?

Social media is chock full of complaints about the price of petrol lately. When it comes to the reasons why, the answers are enough to make Alex Trebek roll over in his grave.

“I guess if the earth were made of gold, men would die for a handful of dirt.”

That is the closing line of a movie called “Garden of Evil” with Gary Cooper and the thinking man’s sex symbol, Susan Hayward. It is a particular guilty pleasure of mine. It also, to me, says a lot about the latest cause d’whine for most Americans commenting on social media, the price of gasoline.

Oil, let’s face it, is nasty, slimy stuff best left in the ground if it weren’t so important to our industrialized world. That gives it a value akin to diamonds. Well, not completely, which you will find if you give your love a can of 30-weight instead of a necklace for Valentine’s Day.

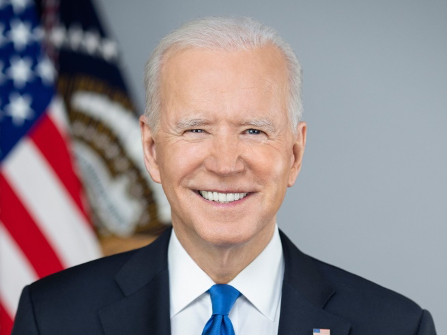

My inbox and Facebook feed are chock full of complaints about the price of petrol these days, and when it comes to the reasons why, the answers they give are enough to make Alex Trebek roll over in his grave. And of course, since we are in the lead up to the mid-term elections, which now begins the day after the last one ended, I’m not surprised that kindly Uncle Joe is the usual culprit.

So let's answer all the claims made by that merry band of petroleum industry experts, who just a month ago were communicable disease experts, on the internet. To quote the demented geniuses of Firesign Theater, “Everything you know is wrong.”

- - We were energy independent during the Trump years, so why not now?

Let’s turn to that storehouse of Democratic Party talking points, the Wall Street Journal. In the energy industry, energy independence means we export more energy than we import. So...

"In 2021, the U.S. exported 3.15 billion barrels of petroleum products and imported slightly less than that. Last year was neck and neck but technically the U.S. was energy independent since it exported more than it imported.

In 2020 — for the first time in 69 years — the U.S. produced more oil than it consumed because the demand for oil dropped, as people weren’t traveling as much.

Last year, U.S. import numbers began to rise and the U.S. Energy Information Administration expects that trend to continue as the demand for oil rises to pre-pandemic levels.

Energy independence could mean lower prices at the pump in the long run but the current spikes are due to the oil market overreacting to uncertainty with Russia."

Here is the point to remember, and we will reinforce this like a really annoying seat belt chime in your car. The oil industry is just like any other. It responds to supply and demand. In 2020, we were all stuck in boring zoom meetings dressed only from the waist up. We weren't driving nearly as much. Pollution and traffic accidents were down because you don't have to drive from the kitchen to the den.

And if the class will settle down, it's time for Econ 101. The crucial thing to bear in mind is, when demand is low, prices are as well. When demand is high, prices go up. We are seeing that time-honored formula play out in everything from gasoline to milk. Add to that the fact that companies of all types are having to play catch up in manufacturing and transport since the pandemic, and you get scarcity.

When something is scarce, and you want it, the price goes up. Witness the diamond I had to buy when my wife poured the can of 30-weight on my head.

- - If only Biden didn't restrict the industry, they could drill, baby, drill.

They can drill, baby, drill now, but they don't want to...baby. There are no restrictions on drilling. We'll address oil leases in the next point.

The oil market always looks ahead. We are seeing oil prices as I write this on March 8th, at $115 a barrel. In the middle of the pandemic, you couldn't give the stuff away. It was literally below zero at one point. Two big banks in New York, have rubbed their hands together in glee and cackled that we'll be at $200 a barrel before long.

That would mean nearly $6 a gallon gas. Now, when I lived in Wyoming, the mantra was similar to Texas, "Lord, give us another oil boom. We promise not to screw it up." Well, we have one but, and here's the big sticking point, the big boys are skittish. They are making record profits right now, and frankly, they don't know how long the jitters in Europe will last. So, they are standing pat on production. One industry executive spoke with NPR's Marketplace program.

"A year and a half ago, shale drillers were struggling for survival. Then travel picked up, and oil rebounded from pandemic lows, but drillers have remained chaste on production. Regular readers will recall that in January, Rick Muncrief, the CEO of Devon Energy, whose stock shot 178% higher last year, told us he’s capping production growth at 5% this year. “We’ve had some head fakes,” he said at the time of past rallies that were killed by overproduction or demand downturns.

I went back to Muncrief to see if he had found any wiggle room, given recent events. “The plan is the same,” he says, and he reminded me that 5% growth is the cap—his production is more likely to be flat this year versus last year. It can take three months to drill a new rig, and Devon uses what are called multiwell pads, each with three to six wells, so if the company goes after more barrels today, it might produce them in nine to 12 months.

Then there’s the matter of “super-backwardation”—what traders call the unusually sharp drop-off in the oil futures curve. The market expects oil prices to fall to $85 or so from $110 over the coming year, whether from pandemic kinks passing or oil buyers finding workarounds for the Russian supply disruption. Futures could be wrong, of course. 'For investors to get excited about adding barrels, the shape of the curve has to change,' Muncrief says."

Add to this that when prices get too high, how will we cope with our 4-wheel-drive Ford F-250 stretch cab? We'll probably drive less than we planned. The general consensus is, we won't cut our demand until oil reaches that $200 a barrel mark. So, they just don't trust that this will last, they are making more money than they know what to do with, so the answer is generally, uh-uh.

2. - If Biden hadn't frozen the right to lease for drilling on public land, they could, uh, drill, baby drill? Maybe?

The answer to this one is simple. They are up to their armpits in leases right now. Yes, future leases are on hold for now, and that means absolutely nothing. American oil producers have a collective 13.9 million acres of land under current lease. They are using less than half of that. 9000 leases are idle. Why would they lease any more when profits are at an all-time high? They'll keep the leases in their back pockets for now until things change.

3. - OK, if he hadn't canceled the Keystone XL pipeline, we wouldn't be in this mess.

The original Keystone Pipeline, a private operation benefitting the Trans-Canada company, is already in operation. It takes Canadian tar sands oil, a particularly difficult type to send down a pipe, to the Gulf Coast for processing. The overwhelming majority of it, and anything the XL leg would send down, will go overseas. The controversy in East Texas over a private company being given the power of eminent domain, is one I covered years ago in this story...

But again, the oil wasn't for us but destined to be loaded on ships and exported to the highest bidder. And again, the original pipeline is in operation as I write this. Yell at Trudeau if you want them to share with us. Otherwise, outbid the other guys.

4. - We are right to cut off the oil we import from Russia. We shouldn't deal with an authoritarian leader like that.

Again, as I fumble my way through this piece on the 8th, the President has just announced we are ending Russian oil imports. They were frankly a matter of convenience as, believe it or not, it was cheaper to buy it from them than ship it to the west coast. And we all agree, it would be better to get it all from ourselves, but if the big boys are not inclined to increase output much right now, so some imports will continue as they always have.

But as for authoritarian leaders? Well, here are the list of countries we import the most from...

Canada, Saudi Arabia, Mexico and Russia.

There are others like Venezuela, also not a government Jefferson would approve, but these are the big hitters. We can lean on Canada, but relations with the others are iffy, and the Saudis, what with murdering journalists and all, kind of fall into that Putin category. At least women can drive in Canada and Mexico.

5. - What about the push for green energy, huh?

OK, I'll bite. What about it? Most power companies in this country are diversifying their power sources. Automakers, as I said in my column a month ago, are electrifying their fleets yearly to help with the climate change problems we all face. You can build windmills and drill for oil at the same time. It isn't a zero-sum game.

But if you want to deny that the climate is a problem and a can we can continue to kick down the road for much longer, then you can stop reading now. I'm not going to argue on behalf of the overwhelming majority of the world's climate scientists with a bunch of Facebook PhD's.

Just remember, not one windmill or solar farm that has been built stopped one oil well from being drilled. And even the most ardent redwood hugger understands that any transition from a fossil fuel economy will take generations. My daughter won't be asking for the keys to my Wrangler when I shuffle off this mortal coil, but someone will want it for years to come. At least until gas becomes too pricy to bear. Besides, I could never interest her in learning to drive a stick.

Hovering over all of this, though, is the situation in Ukraine. As he announced the suspension of Russian oil imports, the President warned that prices will go up some more. The markets took care of that when the invasion began, and if Europe follows suit, expect more pain. OK, not the same pain as having an SU-27 bomb your house, but first world pain, nonetheless.

But to keep it in perspective, the headlines touting a new record gas price are wrong. You have to think in constant dollars, accounting for inflation. For example, we were paying an average of $1.25 for a gallon of precious go-juice in 1980. In today’s dollars, that is $4.52.

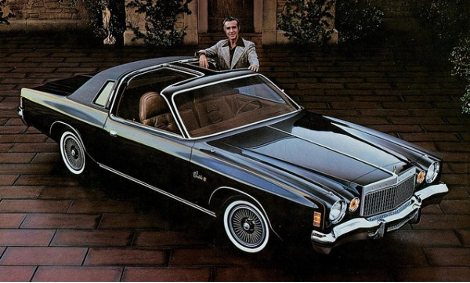

Add to that, salaries have risen as well, though not as much as they should have, and our cars are much more efficient than the Bradley Fighting Vehicles with Corinthian leather that we drove back then.

Lest you think I'm letting big Joe off the hook, I think his response to the Ukraine situation has been unforgivably slow. When the buildup of russkie goose steppers began, the flow of high-tech weapons should have commenced like Lucy's conveyer belt of chocolates.

I mentioned in my last piece, my conversation with Winston Churchill II some years ago. We were talking about his book on defending the west in the Cold War, but a salient point was made. You don't need a tank to kill a tank. You don't need an airplane to kill an airplane. Modern battlefield ordinance is sophisticated enough to do much of the job, as we saw years ago when the boys from Moscow were kicked unceremoniously out of Afghanistan. And that was accomplished with weaponry that is nowhere as good as it is now, and a bunch of guys on horses.

I know the C-5's are flying Stinger and Javelin missiles over now, but that should have happened early on. It's a cool offer, but a hand-full of old MiG's from Poland will be swept aside fairly quickly. Before we entered WWII, and Churchill's father was leading Britain through the worst of the blitz, his plea to the US was, "Give us the tools and we'll finish the job." And we did. A modern version of Lend/Lease was called for two months ago. Now I fear it's too little, too late. That blame falls both on the Resolute Desk and the headquarters of NATO.

But, if the strutting little Mussolini-wannabe in the Kremlin is to be made to pay for all this misery, cutting off his oil, both here and more importantly, in Europe, will be the coup de grâce. We who watch mouths agape and eyes moist at the destruction of the largest country in Europe, will need to be as resolved as our outrage would suggest. This isn’t the time for only hopes and prayers.

Ukraine may, and probably will fall. But if we want to stop not only the sad little El Supremo in Moscow, but his counterpart in Beijing down the road, the pressure shouldn't end with the ending of the Ukraine campaign. That will add more uncertainty for oil producers, making them more reluctant, and will mean uncertainty at the pump, at least until there's a management change in Moscow.

The greatest generation endured rationing and conscription to defeat despots around the world. We can surely endure some price hikes. Well, OK, but just don't make us wear a mask in the Kroger.