How Much is That DOGE in the Window?

Cut science and medical research? Musk won't touch the NASA budget. But the medical side? Well, between RFK, Jr's brain worm and Dr. Oz, we could make measles great again.

Let me say up front that I am all for getting our deficit, and by default, our national debt under control. The last time the US budget was in surplus, a randy little babe hound named Clinton was hanging out in the oval office. The last time before that, it was a fellow Texan named Johnson. And now, with the new administration ready to charge in, we have a couple of over-caffeinated billionaires ready to set up an extra-curricular outfit to get this mess under control.

And as disappointed as I am that we won't be able to reference "Attorney General Matt Gaetz?", I will live, I guess. And make no mistake, his title would have always included the question mark. We'll worry about the others another time. Right now, I want to describe the task Elon Musk and Vivek Ramaswamy have set for themselves.

Parenthetically, I am curious why no one has delved into Musk's wealth being very much a product of US government involvement, from tax breaks for electric vehicles to NASA contracts. Should a guy with skin in the game be deciding where the money goes? Just a question that I'm sure some Democrat in Congress would ask if there were any left alive.

So off they go, cutting the budget by, as Musk said, $2 trillion.

Actual video of first budget session.

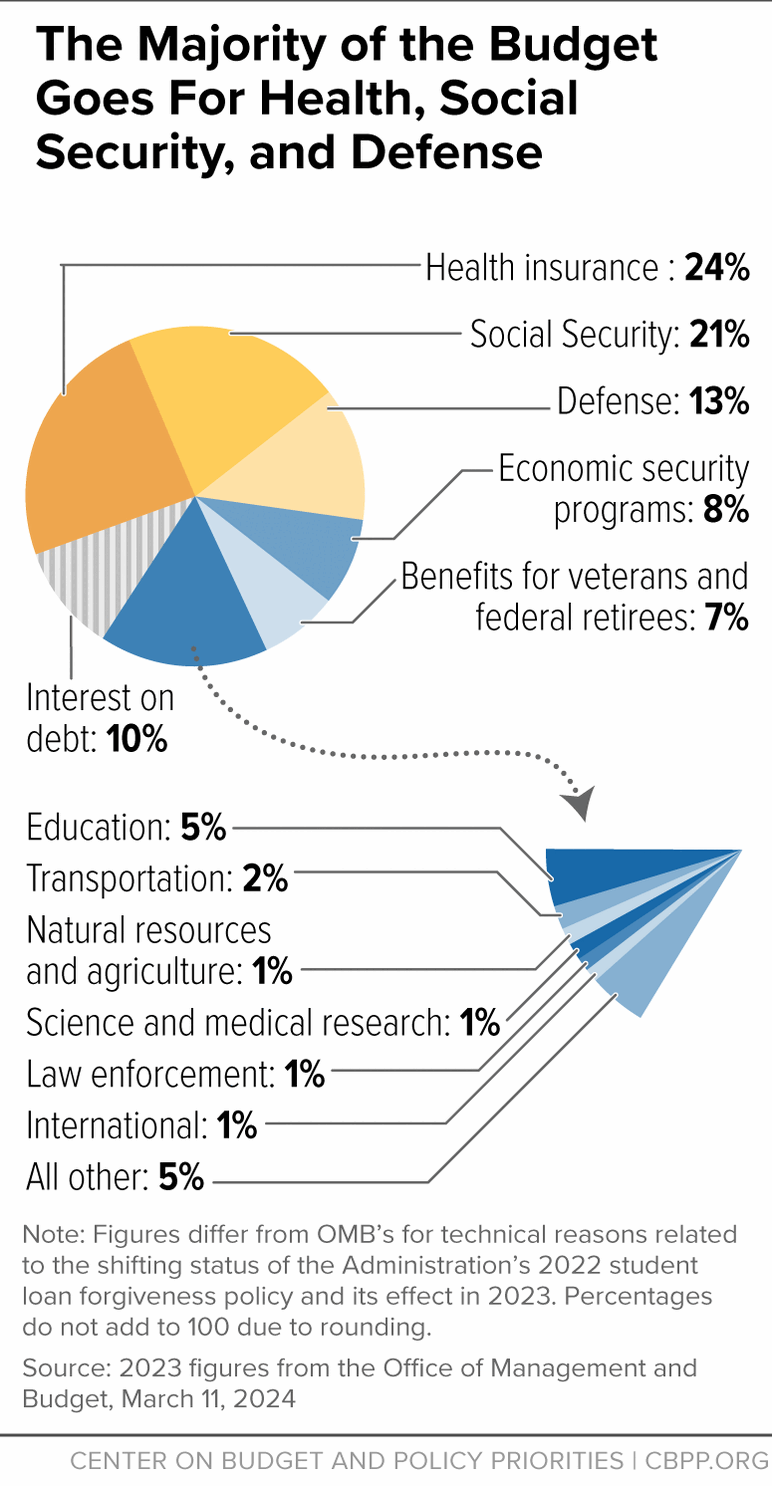

The US budget includes both discretionary and non-discretionary spending. Here is the whole magilla in one pie chart...

And here's the money coming in...

- RevenueThe federal government collected $4.919 trillion in revenue for fiscal year 2024, which is 17.1% of GDP. The largest sources of revenue were:

- Individual income taxes: $2.4 trillion, an 11% increase

- Payroll taxes: $1.7 trillion, a 6% increase

- Corporate income taxes: $529 billion, a 26% increase

- SpendingThe federal government spent $6.752 trillion in fiscal year 2024, which is 23.4% of GDP. The majority of spending was on Social Security.

- DeficitThe federal budget deficit for fiscal year 2024 was $1.833 trillion, which is 6.4% of GDP. This is an increase of $138 billion from the previous year.

But remember, that at least for now, Social Security has it's own discreet funding source. You see it on your paycheck. Will it be enough down the road, of course not. Even though my daughter's generation is actually larger than the baby boomers, the money will still be tight. Neither Elon or Vivek have mentioned increasing revenue, except for the idea of tariffs.

Of course, if we lifted the cap on income on which you pay social security taxes, which is now $168,600, and tax all income for everyone, there would be no problem. But will these two recommend paying SS taxes on all their income, you know, like you and I do? If you believe that, I have some old Harris campaign buttons to sell you.

The President-elect also talked about not taxing Social Security benefits. Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale. But there is obviously a political rationale.

And you just made the daring duo's cost-cutting job tougher.

Now, there has been a lot of palaver about eliminating the Department of Education. And nominating Mrs. Wrestlemania to be the el jefe is a good start as far as many on the right are concerned. But what exactly does it do? I know a lot of folks think that it tells schools what to teach, especially when it comes to, well, you know, that race thing, but all those decisions are made at the state and local level, not in Washington.

Actually, the Department of Education's budget makes up 21% of the total education spending in the United States. The department's responsibilities include:

- Establishing and monitoring federal financial aid policies for education

- Collecting data on schools in the United States

- Disseminating research

That's it. The federal government spends nearly $79 billion annually on primary and secondary education programs. Much of the funding is discretionary, meaning it is set annually by Congress through the appropriations process.

There's a lot of talk about sending all that authority back to the states. Not the money mind you, just the authority to do all that without money. I tried that with the light company when I was young and broke but to no avail. But shaving in the dark was an acquired skill I treasure, should the need arise again.

And even if you did send the money, Texas, Oklahoma and Louisiana would just buy more Bibles. So, student loans, aid to poorer districts, all would be gone. Ask your local ISD if a cut of 21% is a good idea?

Cut science and medical research? It's 1% of the federal pie and includes NASA, the CDC and more. Will Musk touch the NASA budget? Will I find a new Ferrari in my carport? The car is far more likely. But the medical side? Well, between RFK, Jr's brain worm and Dr. Oz, we could make measles great again.

The Defense Department? They are due for an increase, not a cut. A lot of talk during the campaign consisted of mewling over equipment left behind during the Afghan withdrawal and the cost involved. It totaled $7 billion, but for comparison, the stuff we left behind in Vietnam totaled $35 billion in today's dollars. It happens after every war. It costs more to bring the stuff back than to replace it. Farmers in the UK and France were driving surplus US Jeeps for years. The first Land Rover in 1948, was based on the Willys Jeep platform owned by the Wilks brothers who owned the Rover Car company and used it on their farm.

If we didn't leave it, it was often pushed over the side on the way home...

Or as Felix Leiter put it in Casino Royale...

"Does it look like we need the money?"

The offer to forego taxes on worker tips would only cost $100-200 billion over 10 years, but many employers would simply transfer more salaries to tips and that figure would balloon.

How about cutting the size of the government workforce, eh? Well, out of the total US workforce of around 170 million folks, the civilian government tally is 3 million. They can't all be useless. The total government worker salary figure is $305 billion a year. It's 4% of the budget. Now, at General Motors, salaries are about 50-60% of overhead. Sounds like we are getting a bargain compared to one of the largest corporations in the world.

Now look, some cuts are undoubtedly possible and even desirable. But in the 90s under Clinton, a combination of cuts and revenue increases - read taxes - were used and we got the thing into surplus. It isn't magic. And it won't be done overnight, no matter what politicians tell you.

To summarize, you could cut all of the non-defense discretionary parts of the budget - FBI, State Department, interstate highways, space, science, medicines, FAA, FCC, ag support, national parks, everything - and you'd still have a big deficit. And if the promised tax cuts go into effect, it will look worse.

It will be interesting to see what the Hardy Boys come up with. It will be more interesting to see how the public reacts to the programs and services that might be cut. So far the prospect of Gaetz, RFK or Dr. Oz doesn't seem to have fazed them, so who knows?

Oh, and Marjorie Taylor Greene will chair the House committee overseeing their work, so I'm sure we're good on this. Well, at least she and Nancy Mace will keep that new congresswoman out of the lady's room, so we are tackling the important stuff first.

Maybe if we turned the entire debt into crypto, it would just disappear.